…we started the Iraq War. We're not out yet.

Today's just as good as any to remember the 4,261 dead U.S. soldiers.

…we started the Iraq War. We're not out yet.

Today's just as good as any to remember the 4,261 dead U.S. soldiers.

… that there are real people behind these words you see on the computer screen.

I hope this gets talked about more:

Absent supplementals, the United States currently runs a defense budget of just over half a trillion dollars, a number which does not include defense-related spending in other departments. By the kindest calculations, this means that the U.S. spends roughly four to six times as much on defense as our closest competitor. By less kind calculations, we spend about 10 times as much as any other country in the world, accounting for somewhere around 50 percent of aggregate world defense spending. Although the absolute numbers have changed since the early 1990s, the ratios have not. The U.S. has simply dominated world defense spending since the collapse of the Soviet Union, in spite of the fact that most of the other top defense spenders (France, U.K., Japan) are close U.S. allies.

If an analyst had proposed, during the Reagan administration, that the U.S. outspend the Soviet Union by a factor of 5-10, he or she would have been laughed out of government by Republicans and Democrats alike. Today, however, debate over the defense budget almost never results from the question "How much do we need to spend?", or even "Should we spend more or less?", but rather "How much more should we spend?" And this is simply insane, given the massive advantage that the United States enjoys over any potential competitor, and the security gains that the United States has accumulated since the end of the Cold War.

While there are advocates for higher defense spending, almost no one thinks that the U.S. defense budget approaches optimality; even hawks can find half a dozen or so expensive projects that need to be canceled.

Oy:

State Rep. Leo Berman (R-Tyler) proposed House Bill 2800 when he learned that The Institute for Creation Research (ICR), a private institution that specializes in the education and research of biblical creationism, was not able to receive a certificate of authority from Texas' Higher Education Coordinating Board to grant Master of Science degrees.

Berman's bill would allow private, non-profit educational institutions to be exempt from the board’s authority.

“If you don’t take any federal funds, if you don’t take any state funds, you can do a lot more than some business that does take state funding or federal funding,” Berman says. “Why should you be regulated if you don’t take any state or federal funding?”

HB 2800 does not specifically name ICR; it would allow any institution that meets its criteria to be exempt from the board's authority. But Berman says ICR was the inspiration for the bill because he feels creationism is as scientific as evolution and should be granted equal weight in the educational community.

Offer a Masters in Theology. Heck, offer a Masters in Creationism. But don't call it science!

As for Berman's question as to why non-profit education institutions shouldn't be able to give out Masters of Science degrees, the answer is obvious. What would stop Jim Bob's School of Bullshit to start handing out degrees in, well, anything?

Tragic circumstances, obviously. And I bristle at the phrase "talk-and-die syndrome".

Anyway, here's Natasha performing "Maybe This Time" in Cabaret, for which she won a Tony.

The New York Times does a story on people who build replicas of Captain Kirk's command chair from the Enterprise to go into their living rooms.

Um. I guess it makes a good conversation piece for a couple of months, but then what? It's just this weird chair that's…. there. Now, if I was this guy's wife (yes, he's married), and I walked into the room and he was sitting there like that, my eyes would never stop rolling. "Uh, Captain," I would say in a tone dripping with sarcasm, "Have you taken out the trash? And please don't leave your socks on the bedroom floor."

I suspect that most Kirk wannabes end up having their chair relegated to the basement. Like this guy, whose wife threatened divorce if he displayed it in the living room:

Of course, this is even odder, in its own way. "Honey, I'm going down to the basement to sit in 'the chair'. Call me when dinner's ready."

The total cost of all the projects submitted by Winston-Salem in the 2008 U.S. Conference of Mayors report is $618,050,000. This does not mean these projects will get done with North Carolina's federal stimulus gift. That's up to Bev Perdue.

Stimuluswatch.org]Jeez:

Sen. Charles Grassley is standing by his earlier comments suggesting some embattled AIG executives should "resign or commit suicide," but told CNN Tuesday he was merely speaking rhetorically.

"Of course I don't want people to commit suicide," the Iowa Republican said.

No, I didn't think so.

It says something odd about the state of political discourse in this country when a politician has to step back from comments which obviously weren't literal.

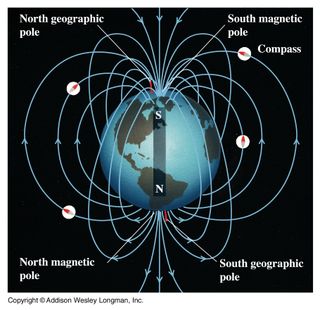

Yes, kids, the Earth is a giant magnet, which is why compasses work.

Yes, kids, the Earth is a giant magnet, which is why compasses work.

But more than that, it's been a scientific fact that birds and bees navigate using the Earth's magnetic fields, which run from the South to the Earth's magnetic North. It's how those flying beasties migrate, or find their hives and nests.

And recently, it's been discovered that large mammals — cows, in particular — may also have a magnetic sense. A recent German study using Google Earth images reports that grazing cows tend too line up north-south in accordance with the magnetic field (unless they are "confused" by nearby heavy-duty power lines).

That said, it's been an old wive's tale that humans can detect magnetic fields as well, and that humans' sleep will improve if they align themselves north-south along the magnetic field. This has led to a small cottege industry of magnetic mattress pads which, some claim, can not only enhance sleep, but cure all kinds of physical ailments.

Is it real, or bogus? Can human sleep/health be improved by positioning our beds in a north-south direction?

Well, the science isn't there yet. On the other hand, it wasn't there a year ago for cows, and now we know better.

So… maybe it's worth rearranging your bedroom. You never know.

Banned high school theatrical productions are in the news a lot lately, and sadly, school administrations seem to win more often than not.

Concerns over adult content in Steve Martin's play Picasso at the Lapin Agile has prompted an Oregon high school superintendent to shut a student production down. Writer-comedian Martin has stepped in and said he will finance an off-campus production of the comedy.

Martin made his intentions known in a letter to the La Grande Observer March 13. He made the offer to pay for a production "to prevent the play from acquiring a reputation it does not deserve," he wrote in a letter to the local paper in eastern Oregon. He added, with characteristic sarcasm, that he hoped the staging would be "low-budget."

After La Grande School District Superintendent Larry Glaze banned the planned presentation of the play at La Grande High School on Feb. 20, the work found a home at Eastern Oregon University's McKenzie Theatre. Martin had offered to fund that May 16-18 run, which was already being supported by the EOU Student Democrats. The cost will likely be shared by Martin and the Student Democrats, with extra money going to a scholarship for theatre students at LHS, the Observer reported.

A La Grande parent sent a letter of complaint — and a petition with 137 signatures by "community members" — to the superintendent, sharing concerns about adult content in the comedy about imagination, inspiration and frustration in the lives of the young Pablo Picasso and Albert Einstein in 1904. The play is set in the bar of the title.

The La Grande School Board stood by the superintendent's decision at a Feb. 25 school board meeting.

Martin's letter is reprinted below the fold….

This is lazy blogging on my part, but The Anonymous Liberal's explanation of AIG's role in our troubled economy is as good a primer as it gets:

Imagine, for a moment, that there was a company that offered stock market insurance. For a small premium–pennies on the dollar–you could buy an insurance policy that compensated you in the event your stock investments lost money. If there were such a company, what would you do? You'd buy a whole lot of stock, of course, and a corresponding insurance policy to hedge your bets. It would be a no-brainer, a low-risk, high-reward investment strategy.

In fact, because you were exposed to so little apparent risk, you'd probably leverage up big time. You'd borrow as much money as you could and you'd buy stock with it (along with corresponding insurance policies). Why not? Your investment gains would be more than enough to cover the interest on your loan. You'd be making money off other people's money.

And everyone else would be too. The ability to cheaply hedge against loss would encourage everyone to buy massive amounts of stock, with borrowed money. With everyone's money pouring into the stock market, stock prices would rise at a brisk and steady pace, seemingly validating everyone's investment strategy. A massive stock market bubble would soon form, but for a while, everyone would make lots of money. The investors would make money. The folks loaning them money would make money. And the insurance company would make lots of money from the premiums it was collecting.

But at some point, people would realize that stocks were greatly overvalued. The bubble would burst and the market would come crashing down. And the insurance company would suddenly owe unfathomable sums of money (much more than it could possibly pay) to everyone who had purchased its stock market insurance policies.

That, in a nutshell, is the story of AIG, except of course that AIG was insuring a different type of investment. AIG was in the business of issuing credit default swaps, which are essentially insurance policies that protect lenders from defaults by borrowers. The availability of cheap credit default swaps turned mortgages into a seemingly risk free investment. Mortgages and mortgage-backed securities paid steady, consistent returns and any downside risk could be effectively hedged by buying AIG's credit default swaps. So demand for mortgage-backed securities shot through the roof. Investment banks couldn't get enough of them. In order to fill the demand, banks and mortgage companies started issuing mortgages to anyone and everyone one who wanted one, even if they had terrible credit. New fly-by-night lenders and new kinds of mortgages suddenly appeared on the scene. They offered no-down payment loans and teaser rates. Anything to get people to sign on the dotted line. The mortgage issuers would then turn around and immediately sell them to investors, thereby insulating themselves from any default risk. As the market flooded with easy credit, housing prices rose at a brisk pace. The steady rise in value encouraged people to take out even bigger loans and to borrow against their apparent equity. The lenders were happy to oblige because the market for mortgages was so strong. The investors kept buying because they were getting steady returns and were insured against loss. The returns were so steady, in fact, that they saw an opportunity to leverage and began buying mortgage securities with borrowed money.

A huge asset bubble was created. Eventually it became so obvious that a bubble existed that savvy investors started buying credit default swaps not as a hedge, but simply because they knew everything was about to come crashing down. And AIG was happy to issue them.

Then the bubble burst. Now AIG is on the hook for all of the ridiculous policies it underwrote. And there's no way it can possibly pay them all off.

I don't mean to imply that this is all AIG's fault. There's a lot of blame to go around, and there were other companies that were in the credit default swap business. But AIG was the worst offender and it played a critical role in creating this fiasco. Without a big company willing to write these insane insurance policies, the situation never would have gotten as out of control as it eventually did. Investors made horrible bets on mortgages and mortgage-backed securities, but they were encouraged to do so by the availability of an easy hedging mechanism, i.e., cheap credit default swaps that AIG issued by the billions without ever considering what would actually happen if home owners began defaulting on their mortgages in large numbers. AIG was as reckless as a company can possibly be.

Pay the AIG executives' bonuses with the toxic assets they created.

UPDATED — A better idea: Congress is thinking about taxing the bonuses at 100%. No, no, no. Tax them at 150%. That way, the exec will simply refuse to take them.

RELATED — From John McCain's twitter feed:

If we hadn't bailed out AIG = no bonuses for greedy execs

Interesting perspective. Well, yes, that's true — the greedy execs wouldn't have gotten their bonuses, because AIG would have gone under. You know what else would have happened? The economy would have collapsed and millions would have found themselves unemployed and struggling to feed their family.

But I guess that's beside the point….

From Michael Steele, the chairman of the RNC (which is second in charge of the Republican Party right behind Rush Limbaugh) on global warming:

“Thank you, thank you,” he said. “We are cooling. We are not warming. The warming you see out there, the supposed warming, and I am using my finger quotation marks here, is part of the cooling process. Greenland, which is now covered in ice, it was once called Greenland for a reason, right? Iceland, which is now green. Oh I love this. Like we know what this planet is all about. How long have we been here? How long? No very long.”

Sigh.

The port of Qaqortoq, Greenland:

Glacier Lake, Iceland:

And yes, Iceland does have a lot of "green", and Greenland does have a lot of "ice", but they weren't named at a time when the reverse was true. Greenland, by the way, was named "Greenland" not because it was entirely green, but because its discoverers wanted people to think it was full of bucolic green pastures, and thus settle the place.