Update to a post I wrote a month ago — turns out that 13 year old kid isn't the father after all.

How Much Cheeto Is In A Bag Of Cheetos?

Cheeto bags are mostly filled with air.

And Cheetos themselves are mostly air.

So how much "cheeto" do you get in a bag of Cheetos?

Some people with nothing better to do decided to find out.

The short answer: Not much. There are two cups of cheese-corn-whatever in an 8.5 ounce bag of Cheetos puffs.

Very Risky Business

In the Washington Monthly, Senator Byron L. Dorgan — I'll only include snippets:

Last spring, when the stock market took its hair-raising ride, in one corner of Wall Street there was more than the usual anxiety. In fact, there was stockbrokers-looking-for-upper-floor-windows kind of fright. In April, clients of the giant Bankers Trust New York Inc.–including Procter & Gamble–took multimillion dollar losses on a kind of trading most Americans had never even heard of, called "derivatives." A rumor went around the Street: Maybe something truly sinister was brewing. Maybe this was a … derivatives collapse.

***

More trouble comes from exotic new derivatives called "swaps." Say Company A has borrowed money at a floating interest rate but is worried that rates might rise. It wants to lock in the rates at the lower level. So it calls a derivatives dealer–often a major bank–to find another company, call it B, which is willing to bet that the floating rates will be more favorable than the set rate. A swap results: Company A will pay a fixed rate of interest to Company B, which will pay a floating market rate to Company A. The risk to Company A is that rates will fall but A will be obligated to pay the higher, fixed rate. The risk to Company B is that B will end up paying higher rates than the fixed rate it receives from A. If you had trouble following that, then you are starting to get the idea. And all of this can be done without anyone even knowing, since such transactions can be done "off book"–effectively concealing them from stockholders and employees. Procter & Gamble bought a floating rate deal like this from Bankers Trust, losing a reported $157 million in the process.

***

But the truly scary thing is how losses like these could spread through the entire banking system. Suppose X, our film company, had entered into a swap with a New York bank. That bank in turn might then enter an offsetting contract with another bank which in turn might continue to pass along that risk on and on and on, perhaps using exchange-traded futures. So now a default by X could create a domino effect: X could not pay its bank, and its bank therefore couldn't make the payments on its offsetting contract, and so on until the chain of losses enters the exchange, where the originally esoteric bet can hurt real businesses. This is not mere fantasy.

***

All that stands between the public and a financial disaster of this sort is the guardians of the banking system in Washington. Regrettably, they are outgunned by the derivatives dealers in several ways. For one, there are fewer examiners than dealers, and many examiners are young and inexperienced. Worse, exotic derivatives–the stuff the big boys are doing–just don't fit within the existing scheme of federal finance regulation. It's a little like asking traffic cops to stop the nation's computer crime.

You get the idea.

But here's the thing: this was written in 1994.

And he proposed a solution back then, too:

The threat is not from foreign competition, or Government deficits or regulation. It is from Wall Street, and a new form of sophisticated financial bingo called derivatives. Even Fortune magazine–hardly a carping business critic–is warning that derivatives could swamp our economy in a sea of red ink.

Fortune estimates the new derivatives game at some $16 trillion, which is more than twice our Nation's total economic output. A single default, the magazine said, could ignite a chain reaction that runs rampant through the financial markets. `Inevitably, that would put deposit insurance funds, and the taxpayers behind it, at risk.'

That is a risk that Congress must not permit. Already the taxpayers of this country are footing the bill for the $500 billion bailout of the savings and loan industry. A gang of financial high-fliers tried to get rich quick on junk bonds and inflated real estate loans, and the taxpayers had to clean up the mess. Congress learned a lesson, or should have, at least.

That is why I am introducing today a bill to protect the taxpayers of this country from a replay of the savings and loan fiasco. Specifically, my bill would prevent banks and other institutions with Federal insurance from playing roulette in the derivatives market. If an institution has deposits insured by the Federal Government, it should not be involved in trading risky derivatives for its own account. Such proprietary trading involves a degree of risk that is totally out of step with safe and sound banking practices. It will not occur if my bill is enacted.

Perhaps we should have listened to him.

Conservative Punditry “WTF?” Statement Of The Day

National Review's Mark Krikorian — who, believe it or not, is executive director of the Center for Immigration Studies — drops in this little gem at the Corner:

During slavery and Jim Crow, a number of blacks moved abroad, to Europe or Africa or the USSR, but again, these movements never gained much traction….

Actually, I think very few slaves got the opportunity to move abroad — like, about zero. Because there were, you know, slaves.

And Liberia? Yeah, that was an African colony formed by ex-slaves, with the encouragement of whites, although typically free blacks didn't elect on their own voliation to emigrate there; rather, the one-way ticket to Liberia was offered to them in exchange for freedom from the bonds of slavery.

But there really really wasn't a significant number of black who moved to Europe during slavery or Jim Crow. There just wasn't.

Pictured below: A black family contemplates their upcoming move to Paris, hoping to trade their forty acres and a mule for frequent flyer miles

UPDATE: National Review's Mark Krikorian responds in the comments below, providing cites.

From what I gather, Krikorian's assertion that there was black emigration during slavery and Jim Crow eras rests upon the fact that some blacks, after serving in Europe during WWI, decided to stay there, mainly in Paris. The actual number of black emigres amounted to "several hundred", out of over 200,000 black Americans who served in the Army (according to Krikorian's sources).

Oh, and then there was a handful of prominent black artists — like James Baldwin and Josephine Baker – who found havens in various European cities.

Still, to suggest that these rare examples represent a "movement" that "never gained traction" certainly overstates the factual truth. Rank-and-file African-Americans — those without benefit of military service or fame — certainly were not in a financial position to move abroad during the eras of Jim Crow and slavery. Especially slavery.

The AIG Exec Resignation

By now, if you're atturned to this sort of thing, you have read the resignation of AIG executive Jake DeSantos which was printed in the New York Times. I encourage you to read the whole thing, but here's a snippet:

It is with deep regret that I submit my notice of resignation from A.I.G. Financial Products. I hope you take the time to read this entire letter. Before describing the details of my decision, I want to offer some context:

I am proud of everything I have done for the commodity and equity divisions of A.I.G.-F.P. I was in no way involved in — or responsible for — the credit default swap transactions that have hamstrung A.I.G. Nor were more than a handful of the 400 current employees of A.I.G.-F.P. Most of those responsible have left the company and have conspicuously escaped the public outrage.

….

I take this action after 11 years of dedicated, honorable service to A.I.G. I can no longer effectively perform my duties in this dysfunctional environment, nor am I being paid to do so. Like you, I was asked to work for an annual salary of $1, and I agreed out of a sense of duty to the company and to the public officials who have come to its aid. ….

….

My guess is that in October, when you learned of these retention contracts, you realized that the employees of the financial products unit needed some incentive to stay and that the contracts, being both ethical and useful, should be left to stand. That’s probably why A.I.G. management assured us on three occasions during that month that the company would “live up to its commitment” to honor the contract guarantees.

….

You’ve now asked the current employees of A.I.G.-F.P. to repay these earnings. As you can imagine, there has been a tremendous amount of serious thought and heated discussion about how we should respond to this breach of trust.

As most of us have done nothing wrong, guilt is not a motivation to surrender our earnings. We have worked 12 long months under these contracts and now deserve to be paid as promised. None of us should be cheated of our payments any more than a plumber should be cheated after he has fixed the pipes but a careless electrician causes a fire that burns down the house.

Many of the employees have, in the past six months, turned down job offers from more stable employers, based on A.I.G.’s assurances that the contracts would be honored. They are now angry about having been misled by A.I.G.’s promises and are not inclined to return the money as a favor to you.

….

So what am I to do? There’s no easy answer. I know that because of hard work I have benefited more than most during the economic boom and have saved enough that my family is unlikely to suffer devastating losses during the current bust. Some might argue that members of my profession have been overpaid, and I wouldn’t disagree.

That is why I have decided to donate 100 percent of the effective after-tax proceeds of my retention payment directly to organizations that are helping people who are suffering from the global downturn. This is not a tax-deduction gimmick; I simply believe that I at least deserve to dictate how my earnings are spent, and do not want to see them disappear back into the obscurity of A.I.G.’s or the federal government’s budget. Our earnings have caused such a distraction for so many from the more pressing issues our country faces, and I would like to see my share of it benefit those truly in need.

On March 16 I received a payment from A.I.G. amounting to $742,006.40, after taxes. In light of the uncertainty over the ultimate taxation and legal status of this payment, the actual amount I donate may be less — in fact, it may end up being far less if the recent House bill raising the tax on the retention payments to 90 percent stands. Once all the money is donated, you will immediately receive a list of all recipients.

AIG Execs Return Bonuses

At least 9 of the top 10 have returned the bonus though as an overall percentage of the $218 billion, it still has plenty of room to grow.

Nine of the top 10 recipients of

Before They Were Famous…

Michael Emerson (Ben from Lost) did an educational film for the Federal Bureau of Prisons in 1992. He comes in at the -12:00 mark.

That was for you, Emily. And for me…

Evangeline Lilly (Kate from Lost) did a phone sex ad:

Brad Pitt did a Pringles commercial:

Paul Rudd did a French Nintendo commercial:

A barely-recognizable Ben Affleck did a Burger King commercial:

So did Sarah Michelle Geller:

Family Circus Phoning It In

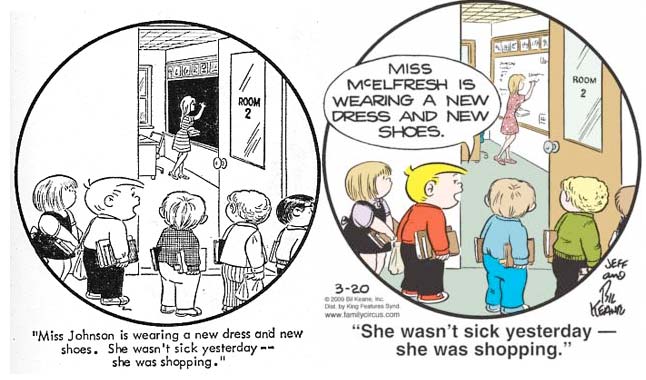

Over at the Comics Curmudgeon, a reader noticed that Bil Keane, artist of Family Circus is recycling old Family Circus cartoons. At the left is a Family Circus from 1970 or 1971; on the right is the one printed in last Friday's newspapers:

Aside from the color, the placement of the caption, and the name change of the teacher, the only difference is that Billy's shoe is tied. Oh, and the teacher no longer has the be-donk-a-donk that she had in the early 70's.

“Nice Little Country You Have Here; Be A Shame If Something Happened To It”

Meanwhile, Treasury Secretary Timothy Geithner and his colleagues worked the phones to try to line up support on Wall Street for the plan announced Monday. They told executives they don't favor using the tax code to retroactively penalize specific individuals who had received bonuses, according to people familiar with the calls. They asked officials to sign on "in pencil, not ink," and to "validate" or "express support" for the plan, these people say.

Some bankers say they turned the conversations into complaints about the antibonus crusade consuming Capitol Hill. Some have begun "slow-walking" the information previously sought by Treasury for stress-testing financial institutions, three bankers say, and considered seeking capital from hedge funds and private-equity funds so they could return federal bailout money, thereby escaping federal restrictions.(…)

Bankers were shell-shocked, especially when Congress moved to heavily tax bonuses. When administration officials began calling them to talk about the next phase of the bailout, the bankers turned the tables. They used the calls to lobby against the antibonus legislation, Wall Street executives say. Several big firms called Treasury and White House officials to urge a more reasonable approach, both sides say. The banks' message: If you want our help to get credit flowing again to consumers and businesses, stop the rush to penalize our bonuses.

Wow. They want bailouts, no strings attached, and if they receive criticism, they threated to destroy the economy.

That's economic terrorism

Don’t Get Fooled By Freecreditreport.com

The Federal Trade Commission (FTC) recently issued a warning about deceptive websites that claim to offer free credit reports. These sites actually end up charging their customers for credit monitoring subscriptions, and they don’t even offer anything you can’t already get for free.

As the FTC says, “Despite the musical claims of some TV commercials, the only authorized source to get your free annual credit report under federal law is AnnualCreditReport.com.”

Federal law requires each of the big three credit bureaus to give you a free credit report every year. That means you can get three credit reports annually, all without paying a dime.

Many financial advisers recommend that you check your credit report once a year to make sure that the information is correct and to protect your identify. Because you have three free reports, however, you can check your credit report every four months and have peace of mind year-round.

Here’s a video from the FTC explaining the difference between AnnualCreditReport.com and all the imitators. The difference? Their service is actually free. “FreeCreditReport.com’s” annoying jinglers are hoping you forget to cancel your “free” account so they can hit you with the associated fees. Those commercials don’t come free you know.

For What It’s Worth

As of today, I'm the exact same age (down to the day) as JFK when he was killed.

He accomplished a little bit more than I have….

How Now Dow Jones

The Dow is up over 400 points right now. If it stays that way, it will be the 15th largest gain in history (point-wise, not percentage-wise).

I guess that means Wall Street likes Geitner's plan… but I'm not sure that's a good thing or a bad thing, seeing as how Wall Street got us in this mess in the first place, and made a mint by doing so.

UPDATE (3:41 pm): It's now up 434.72.

UPDATE (4:00 pm): Dow closed up just shy of 500 points (497.48), making it the 5th largest point gain in history, and, at 6.84%, the 20th largest percentage gain in history.

When Volcanos Tweet

Yes, Mount Redoubt in Alaska, the volcano which erupted last week, has its on Twitter account so you can follow along.