U.S. stocks fell sharply at the start of trade today, following a series of worrying data on global economic growth, and after the yield on the 10-year U.S. Treasury note fell below that of the 2-year note, marking an inversion of the main measure of the yield curve and flashing a recession warning signal.

The yield on the 10-year U.S. Treasury note TMUBMUSD10Y, -5.70% fell below that of the 2-year U.S. Treasury note TMUBMUSD02Y, -4.38% for the first time in more than a decade.

And there it is – the US 2s/10s yield curve inverts for the first time since 2007. This development has preceded every US recession over the past 45 years. pic.twitter.com/I7UAeuhzGf

— Jamie McGeever (@ReutersJamie) August 14, 2019

An inverted yield curve is widely seen as a recession indicator, as it signals that investors believe the economy will slow significantly or contract in the near future. “Given prior inversions of other curves . . . the fact that the 2-year note and the 10-year note has now inverted isn’t ‘fake news,’ wrote Justin Walters, co-head of research and investments at Bespoke Investment Group, wrote in a Wednesday note to clients. “Inversions are not a good sign for the economic outlook, having preceded prior recessions with frightening regularity.”

By the way, this seems to have nothing to do with China tariffs. Trump has delayed imposing more.

Commerce Secretary Wilbur Ross tells the @SquawkCNBC team that the Trump administration’s decision to delay upcoming tariffs on certain Chinese goods was not a trade concession to China. Ross said the decision was made to help American consumers. https://t.co/9pHnrAuFRW pic.twitter.com/midbtZRJWH

— CNBC (@CNBC) August 14, 2019

But wait… if China is paying for the tariffs and NOT American consumers, then why would it affect our Christmas season?

The answer of course is that Trump is lying when he says China will pay for the tariffs.

But again, as I said, today’s plummet is not related to the tariff decision.

As of 9:55 a.m., the Dow is down 400 points, although it was down 450 at one point.

11:30 a.m. — Down 530 points.

And Trump is deflecting blame:

“The Fed has got to do something! The Fed is the Central Bank of the United States, not the Central Bank of the World.” Mark Grant @Varneyco Correct! The Federal Reserve acted far too quickly, and now is very, very late. Too bad, so much to gain on the upside!

— Donald J. Trump (@realDonaldTrump) August 14, 2019

Noon – Down 640.

1:15 pm. Dow is down 720 point. I expect it’ll bounce back at this point. A little.

Trump is obviously aware of the situation, given his (odd) tweets:

Tremendous amounts of money pouring into the United States. People want safety!

— Donald J. Trump (@realDonaldTrump) August 14, 2019

I…. I don’t know what that means. Money pouring in from WHERE? What people? What kind of safety?

The Great Charles Payne @cvpayne correctly stated that Fed Chair Jay Powell made TWO enormous mistakes. 1. When he said “mid cycle adjustment.” 2. We’re data dependent. “He did not do the right thing.” I agree (to put it mildly!). @Varneyco

— Donald J. Trump (@realDonaldTrump) August 14, 2019

Ah, maybe his staff has taken over Twitter again. We’re back to blaming the Fed.

Flashback:

2:35 pm — bounced up about 100 points and came down again. Now down 745 for the day.

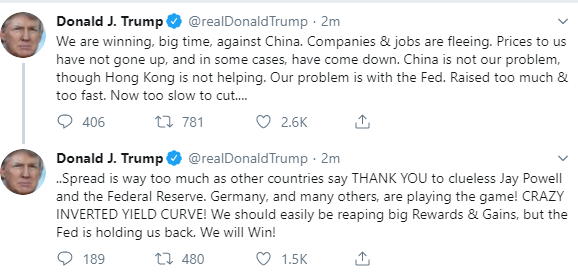

3:30 pm — very volatile, but around 780 down. It broke 800 at one point. Trump notes the inverted yield curve (in all caps) like some insane homeless person on the street corner. Blames the Fed Chairman again.

4:01 pm — Dow closes for the day. Down 800.49 points, or 3.05%, the biggest percent drop of 2019 and the 4th-largest daily point drop on record. S&P 500 ends down 2.95%, Nasdaq falls 3.02%

U.S. stocks, as measured by the S&P 500, are flat since January 2018 pic.twitter.com/sfRren5cW3

— West Wing Reports (@WestWingReport) August 14, 2019

And the GOP seems deaf to all this. They tweeted this at 4:21 pm after the Dow closed.

No MAGIC WAND here— just the results of @realDonaldTrump’s pro-growth policies! https://t.co/4IsPhK7HkM

— GOP (@GOP) August 14, 2019