Okay, follow me on this. It's not too difficult.

We all know that there has been overall economic growth in the past two decades. But the complaint of the OWS movement it that overall economic growth does not raise all boats of the economic stratosphere. Conservatives, on the other hand, will try to tell you that because of trickle-down economics, when the wealthy benefit, everyone does.

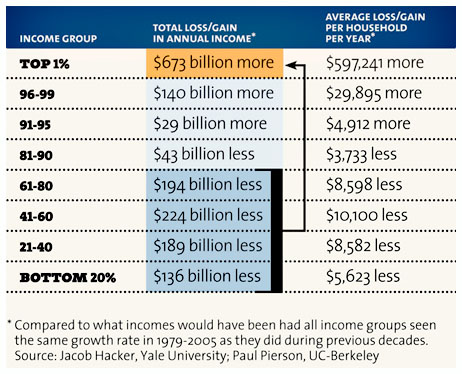

Who's right? Well, this chart from the Center on Budget and Policy Priorities tells us the OWS folks are right. What is the chart? It's a chart that compares how much income various groups make today vs. how much they would be making if everyone's incomes, rich and poor alike, had grown at similar rates since 1979.

So, for example, if you are in the bottom 20% of the income scale, you have $5,623 less per year than you would have if all income groups had benefitted equally from the economic boom. That's the price that the bottom 20% "pay" for the growing plutocracy.

As you can see, by 2005 the bottom 80% were collectively earning about $743 billion less per year while the top 1% were earning about $673 billion more. It's sort of uncanny how close those numbers are. For all practical purposes, every year about $700 billion in income is being sucked directly out of the hands of the poor and the middle class and shoveled into the hands of the rich.

Some might argue, "Well, it is the wealthiest people who created the economic boom over the past twenty years, so of course their percentage should be higher."

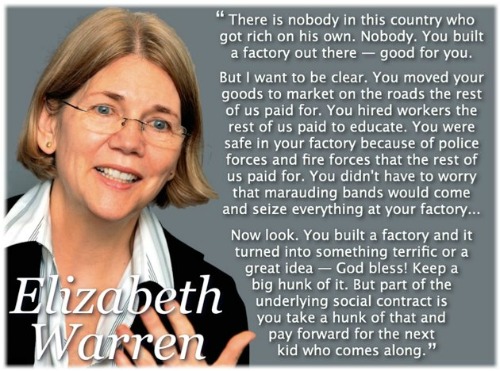

There are two responses to that. One from Elizabeth Warren:

The more complete answer though, in my view, comes from Matt Tiabbi and others who note that the economic progress was actually created not from innovation and winning business strategies, but from cheating.

1) While ordinary people have to borrow their money at market rates, multi-millionaires like Lloyd Blankfein and Jamie Dimon get billions of dollars for free, from the Federal Reserve.

2) If you or I miss a $7 payment on a Gap card or, heaven forbid, a mortgage payment, you can forget about the great computer in the sky ever overlooking your mistake. But serial financial fuckups like Citigroup and Bank of America overextended themselves by the hundreds of billions and pumped trillions of dollars of deadly leverage into the system — and got rewarded with things like the Temporary Liquidity Guarantee Program, an FDIC plan that allowed irresponsible banks to borrow against the government's credit rating.

3) When a homeowner screws up and can't pay a mortgage, they get foreclosed on. But time after time, when big banks screw up and make irresponsible bets that blow up in their faces, they've scored bailouts.

4) And of course, the tax situation:

Bankers on Wall Street pay lower tax rates than most car mechanics. When Warren Buffet released his tax information, we learned that with taxable income of $39 million, he paid $6.9 million in taxes last year, a tax rate of about 17.4%.

Most of Buffet’s income, it seems, was taxed as either "carried interest" (i.e. hedge-fund income) or long-term capital gains, both of which carry 15% tax rates, half of what many of the Zucotti park protesters will pay.

As for the banks, as companies, we've all heard the stories. Goldman, Sachs in 2008 – this was the same year the bank reported $2.9 billion in profits, and paid out over $10 billion in compensation — paid just $14 million in taxes, a 1% tax rate.

Bank of America last year paid not a single dollar in taxes — in fact, it received a "tax credit" of $1 billion. There are a slew of troubled companies that will not be paying taxes for years, including Citigroup and CIT.

When GM bought the finance company AmeriCredit, it was able to marry its long-term losses to AmeriCredit's revenue stream, creating a tax windfall worth as much as $5 billion. So even though AmeriCredit is expected to post earnings of $8-$12 billion in the next decade or so, it likely won't pay any taxes during that time, because its revenue will be offset by GM's losses.

Thank God our government decided to pledge $50 billion of your tax dollars to a rescue of General Motors! You just paid for one of the world's biggest tax breaks.

So when you add all these things together, you learn that the rules are rigged so that the rich can generate wealth for themselves — incredible wealth — not by providing better products and services, but by simply playing a game where the rules that apply to the rest of us don't apply to them.

And if you need a more blatent example, there's this: the raiding of employee pension funds for corporate profit — literally taking money from the little guy and putting into into the big guy's pockets. Happens all the time, according to Ellen Schultz – an award-winning Wall Street Journal reporter and author of Retirement Heist: How Companies Plunder and Profit from the Nest Eggs of American Workers.

Corporations have been "exaggerating their retiree burdens" and plundering retirement plans in a variety of ways, including:

- Siphon billions of dollars from their pension plans to finance downsizings and sell the assets in merger deals.

- Overstate the burden of rank-and-file retiree obligations to justify benefits cuts, while simultaneously using the savings to inflate executive pay and pensions.

- Hide growing executive pension liabilities, which at some companies now exceed the liabilities for the regular pension plans.

- Purchase billions of dollars of life insurance on workers and use the policies as informal executive pension funds. When the insured workers and retirees die, the company collects tax-free death benefits.

- Exclude millions of low-paid workers from 401(k)'s to make the plans more valuable to the top-paid.

According to Schultz, these and related measures have become commonplace among Fortune 500 companies, including AT&T, Bank of America, JP Morgan, IBM, Cigna, General Motors, GM, Comcast, UPS and the NFL, just to name a few.

And that's what OWS is all about.