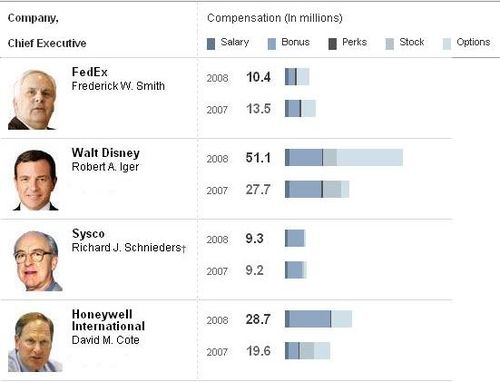

If there's anything to glean from this NYT chart on executive compensation, it's the fact that it is so arbitrary. For example, each of the executives below received wildly different compensation in 2008, yet all of their companies had revenue at around $37 billion that year:

What gives? There seems to no rationality to this.

But Matt Yglesius notes two patterns:

One is that American executives get paid wildly more than do European executives to run basically comparable firms. Look at executive pay in the supermajor oil firms and it’s clear that nationality rather than business acumen is driving the differentials.

The other big issue is that CEOs of newish companies, especially tech companies, tend to have much lower salaries. The issue, presumably, is that these guys are major stockholders in the firm. Steve Balmer is one of the richest men in America notwithstanding his low pay since Microsoft is a successful company. But if he were to pull a John Thain and render his company worthless through business blunders, he’d tumble down the list.

He argues that the Balmer model is the way to go. If Microsoft were to tank, then Balmer's overall compensation would tank. Seems fair.