In the Washington Monthly, Senator Byron L. Dorgan — I'll only include snippets: Last spring, when the stock market took its hair-raising ride, in one corner of Wall Street there was more than the usual anxiety. In fact, there was stockbrokers-looking-for-upper-floor-windows kind of fright. In April, clients of the giant Bankers Trust New York Inc.–including Procter & Gamble–took multimillion dollar … Read More

Conservative Punditry “WTF?” Statement Of The Day

National Review's Mark Krikorian — who, believe it or not, is executive director of the Center for Immigration Studies — drops in this little gem at the Corner: During slavery and Jim Crow, a number of blacks moved abroad, to Europe or Africa or the USSR, but again, these movements never gained much traction…. Actually, I think very few slaves … Read More

The AIG Exec Resignation

By now, if you're atturned to this sort of thing, you have read the resignation of AIG executive Jake DeSantos which was printed in the New York Times. I encourage you to read the whole thing, but here's a snippet: It is with deep regret that I submit my notice of resignation from A.I.G. Financial Products. I hope you take … Read More

AIG Execs Return Bonuses

At least 9 of the top 10 have returned the bonus though as an overall percentage of the $218 billion, it still has plenty of room to grow. Nine of the top 10 recipients of

Before They Were Famous…

Michael Emerson (Ben from Lost) did an educational film for the Federal Bureau of Prisons in 1992. He comes in at the -12:00 mark. That was for you, Emily. And for me… Evangeline Lilly (Kate from Lost) did a phone sex ad: Brad Pitt did a Pringles commercial: Paul Rudd did a French Nintendo commercial: A barely-recognizable Ben Affleck did … Read More

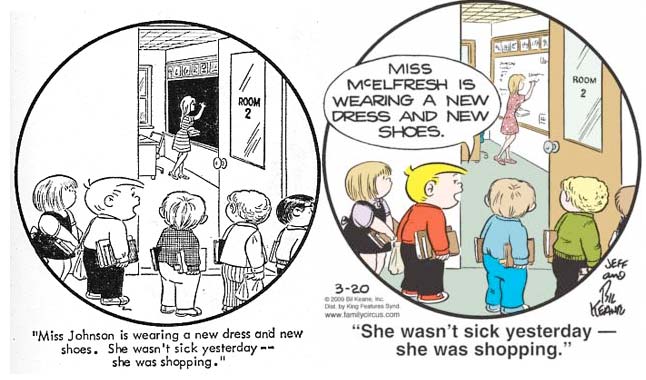

Family Circus Phoning It In

Over at the Comics Curmudgeon, a reader noticed that Bil Keane, artist of Family Circus is recycling old Family Circus cartoons. At the left is a Family Circus from 1970 or 1971; on the right is the one printed in last Friday's newspapers: Aside from the color, the placement of the caption, and the name change of the teacher, … Read More

“Nice Little Country You Have Here; Be A Shame If Something Happened To It”

Wall Street Journal: Meanwhile, Treasury Secretary Timothy Geithner and his colleagues worked the phones to try to line up support on Wall Street for the plan announced Monday. They told executives they don't favor using the tax code to retroactively penalize specific individuals who had received bonuses, according to people familiar with the calls. They asked officials to sign on … Read More

Don’t Get Fooled By Freecreditreport.com

Econ4U: The Federal Trade Commission (FTC) recently issued a warning about deceptive websites that claim to offer free credit reports. These sites actually end up charging their customers for credit monitoring subscriptions, and they don’t even offer anything you can’t already get for free. As the FTC says, “Despite the musical claims of some TV commercials, the only authorized source … Read More

For What It’s Worth

As of today, I'm the exact same age (down to the day) as JFK when he was killed. He accomplished a little bit more than I have….

How Now Dow Jones

The Dow is up over 400 points right now. If it stays that way, it will be the 15th largest gain in history (point-wise, not percentage-wise). I guess that means Wall Street likes Geitner's plan… but I'm not sure that's a good thing or a bad thing, seeing as how Wall Street got us in this mess in the first place, … Read More

When Volcanos Tweet

Yes, Mount Redoubt in Alaska, the volcano which erupted last week, has its on Twitter account so you can follow along.

Tea Parties And “Going Galt”

Outside the Beltway's Alex Knapp: I’ve been following the growing “Tea Party” and “Going Galt” movements with no small amount of amusement, in part because there is really just too much sweet, delicious irony surrounding both of these groups of people (who, I might add, are largely the same people). Here’s a few observations: The “Tea Parties”, of course, started … Read More

Schilling Retires

His blog is down — probably from the deluge of hits — but he announced today that he is leaving baseball, at the age of 42, with "zero regrets". He was out all last season with a shoulder injury, and his best days are behind him, so it's not a major blow to the Red Sox. But still, he was … Read More

PPIP aka “The Geitner Plan”

Get used to that acronym. It's the shorthand term for the plan, unveiled today, about how to deal with the "toxic assets", which is at the core, the epicenter, the root, of all our current economic woes: Here it is in a nutshell: Under the new so-called "Public-Private Investment Program", taxpayer funds will be used to seed partnerships with private … Read More