From The Hill:

I find myself in agreement with the folks at Sadly, No, with their message to Democratic politicians who want the uber-wealthy to have tax cuts:

If, in the middle of the worst economy in a lifetime, with unemployment and poverty at toxic levels, you can’t bring yourself to tell the most privileged amongst us that they ought to resume chipping in a couple of percentage points more at the top marginal rate, why even call yourself a Democrat?

This country really is going to the dogs. And it’s being pushed in that direction by wealth disparity that is third-worldish in its propensity for beating down the psyches of the have-nots — only our national mythology of studiously denying that the vast majority of have-nots (including you!) are in fact never-wills prevents the whole thing from crumbling. That and the insidious creep throughout society over the past 40 years of the Randian philosophy of selfishness, rich people worship and the attendant calculated purging of empathy from the citizenry.

I'm fairly certain that many of the Dinos listed above are facing tough races in their respective districts, and that's why they feel they have to come out in favor of tax cuts for the rich.

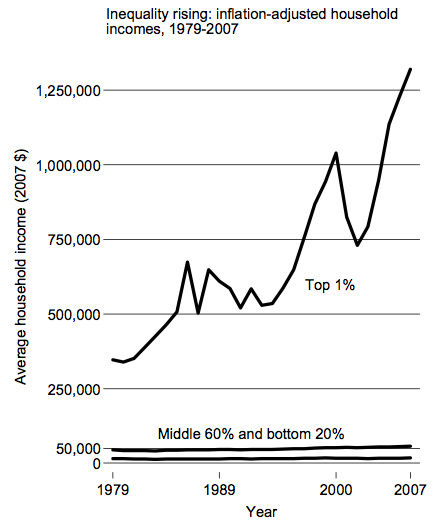

Except they don't. A recent CBS poll finds that 53 percent of respondents now favor having the nation’s top earners contribute a little bit more to the country that made them so fabulously wealthy. A good politician should be able to make this argument convincingly. All you need is a graph, like this:

Point being that the uber-wealthy have done just fine — thank you very much — over the past 30 years. The Top 1% has more than tripled its income (300%) with fairly steady growth since 1980. The middle and lower classes have seen only about a 15% increase in real income with all of those gains coming after the early 90s.

That's an easy thing for voters to understand. So tell me, why shouldn't we keep taxes only slightly higher for those in the top income brackets?

UPDATE: Gotta give props to The Rude Pundit:

In Fort Myers, Florida, the Salvation Army reports a 60% jump in families seeking its services.

In Tucscon, Arizona, a local soup kitchen has seen the number of people it serves nightly go from an 40 to 150-200.

In the last year, in Livingston County, Michigan, the number of people looking for food and cash assistant has risen by over 30%. In Jackson County, it's up over 24%.

In Texas, more than one out of every four kids under the age of 18 lives in poverty. That's higher than the national average of one out of every five. And over a quarter of the entire state is without health insurance. Charities there report 25-50% more demand for food and assistance since 2008.

In Steuben County, New York, homelessness has risen by 15% since 2009. And Catholic Charities says that it's serving 33% more people than last year.

In Minnesota, "At Families Moving Forward, a Minneapolis network of churches offering shelter to families with children, the number of calls for housing has shot up from 50 for every opening to 150."

According to the census, the poverty rate in the United States has risen from 13.2% in 2008 to 14.3% in 2009. For those of you doing math, that's one out of every seven Americans. Income has fallen. The number of people without health insurance has risen. Extended unemployment benefits are all that kept 3.3 million more people from falling below the cruel poverty line.

Oh, and by the way: "The top fifth of households accounted for 50.3% of all pre-tax income; the bottom two-fifths got 12%." When it comes to tax cuts and discretionary spending cuts, we're arguing about what now?